Why Foreign Firms in China Are Losing Out to Homegrown Rivals

Three years ago, China overtook the United States to become the world’s most popular destination for foreign investment. Increasingly, however, overseas enterprises are finding that doing business in China is harder than it seems.

Recent years have seen reports of foreign retail companies shedding staff and closing stores, foreign-funded banks experiencing slow growth and reduced market share, and some enterprises pulling out of China altogether. Even in the flourishing digital sector, foreign firms have found themselves outmatched by local competitors: Ride-hailing service Uber lost out to Didi Chuxing, for example, and Xiaozhu outclassed online hospitality service Airbnb.

The failure of foreign capital to penetrate the Chinese market can be attributed to a variety of factors. For one, since 2007, foreign firms have no longer been entitled to preferential tax policies such as a corporate income tax of 15 percent — compared with 33 percent for domestic enterprises. In addition, Chinese labor costs are on the rise.

But there are two more big reasons why foreign firms have been unable to crack the China market. The first is their inability to adapt to the Chinese system. In 2014, Audi, Chrysler, and 23 Japanese auto parts manufacturers — including Mitsubishi Motors, Furukawa, and Seiko — were accused of engaging in monopolistic practices. Looking to make an example of them, the Chinese government slapped the businesses with hefty fines. In an article published at the time, the American magazine Fortune noted: “Lately, CEOs of some of the largest Western multinationals are finding that they are not exactly being treated like friends. New Chinese leaders have adopted a far less cordial policy toward foreign businesses operating in China.”

Certain commentators have accused the government of selectively enforcing the law to target foreign firms. Although the government argues that there is no evidence for this claim, one thing is certain: China has a less established rule of law system than many Western countries, which leaves plenty of room for rent-seeking behavior to flourish.

The U.S.’s 1977 Foreign Corrupt Practices Act (FCPA) restricts American firms from bribing or otherwise unlawfully influencing foreign officials, among other provisions. Two decades later, the U.S. and 33 other nations signed the OECD Anti-Bribery Convention, an agreement that China is not party to. Acting under American influence, other countries have ratified domestic laws similar to the FCPA.

These laws, the financial systems they’ve helped create, and the corporate cultures they’ve helped spawn have all affected the ability of foreign firms operating in China to develop the kind of close interpersonal contacts needed to influence government organs and regulatory bodies. They also make it harder for foreign companies to use legal gray areas to gain competitive advantages and ultimately flourish in a Chinese business environment.

As perverse as it may sound, foreign firms often lose out in China precisely because they play by all the rules. This is most commonly seen in companies’ treatment of personnel. Foreign firms operating in China tend to take a relatively aboveboard approach to compensation, insurance, housing stipends, vacation, and taxation. Meanwhile, local firms will often implement legally questionable schemes in order to dodge taxes, such as encouraging staff to submit reams of tax-deductible expense claims or paying staff low basic wages and claiming the rest of their salaries on expenses. As a result, even in cases where a local company and a foreign firm pay their employees the same amount, the local firm’s expenses are lower, giving them a competitive edge.

Another example can be found in the tech world. Whenever the internet comes into contact with traditional markets, new business models arise. Such innovative models are soon faced with a thicket of regulatory difficulties, forcing companies to navigate a web of government departments. Not only is this an area where foreign firms lack knowledge, but their very nature as foreign-funded companies predisposes regulatory bodies to mistrust their intentions.

The second major challenge lies in the differences in corporate culture between domestic and foreign firms. Foreign enterprises often have less intense and less productive work environments. In low-income countries, workers generally want to increase their salaries, and they are often willing to work longer hours in order to do so. But once workers begin to enjoy higher overall incomes, further salary increases bring employers comparatively low benefits. In this environment, workers begin valuing increased free time and want to reduce the amount of time they spend at work.

Currently, salaries in China are lower than those in the developed West, where many foreign firms are based. This means that Chinese workers continue to accept longer workdays, and the job market is fiercely competitive. While some Chinese employees would prefer to have more leisure time, they still must compete with highly motivated colleagues.

While laws can protect workers’ rights, including their right to vacation time, legislation can’t do anything about the fact that staff who are more willing to work overtime and give up their vacations are also more likely to receive promotions and salary raises than those who aren’t. Consequently, Chinese work environments are often characterized by universal overtime and an intense work ethic. But the corporate cultures of foreign enterprises actually discourage such behavior.

Of course, having comfortable employees does not mean a company is doomed to failure. Many Apple and Google employees enjoy relaxed work cultures even as their creativity has transformed the companies themselves into the two most powerful corporate entities in the world. Innovation is the result of knowledge, experience, passion, tenacity, lively discussions, and an egalitarian work environment — and China’s private enterprises, especially its tech companies, have done a good job internalizing these values, despite fostering more intense work environments than their American counterparts.

The work ethic found in Chinese tech companies, a field where innovation is king, has not seemingly had a negative effect on their workers’ overall creativity, which has given their employers an edge in market competitiveness in the same way Japan’s postwar boom was to an extent the result of that generation’s work ethic. Meanwhile, the more relaxed work atmospheres found in foreign firms have actually had a negative impact on their competitiveness.

The obstacles to success that China’s foreign enterprises stumble over stem in part from an inability to adapt to the country’s legal realities, and in part from the more hardworking cultures found at domestic companies. While local staff wax lyrical about the fair, relaxed, and lucrative jobs on offer at Western-backed firms, these workers’ comparative job satisfaction is actually bad for business. Often, it’s just that their employers are too upstanding to do anything about it.

Translator: Kilian O’Donnell; editors: Wu Haiyun and Matthew Walsh.

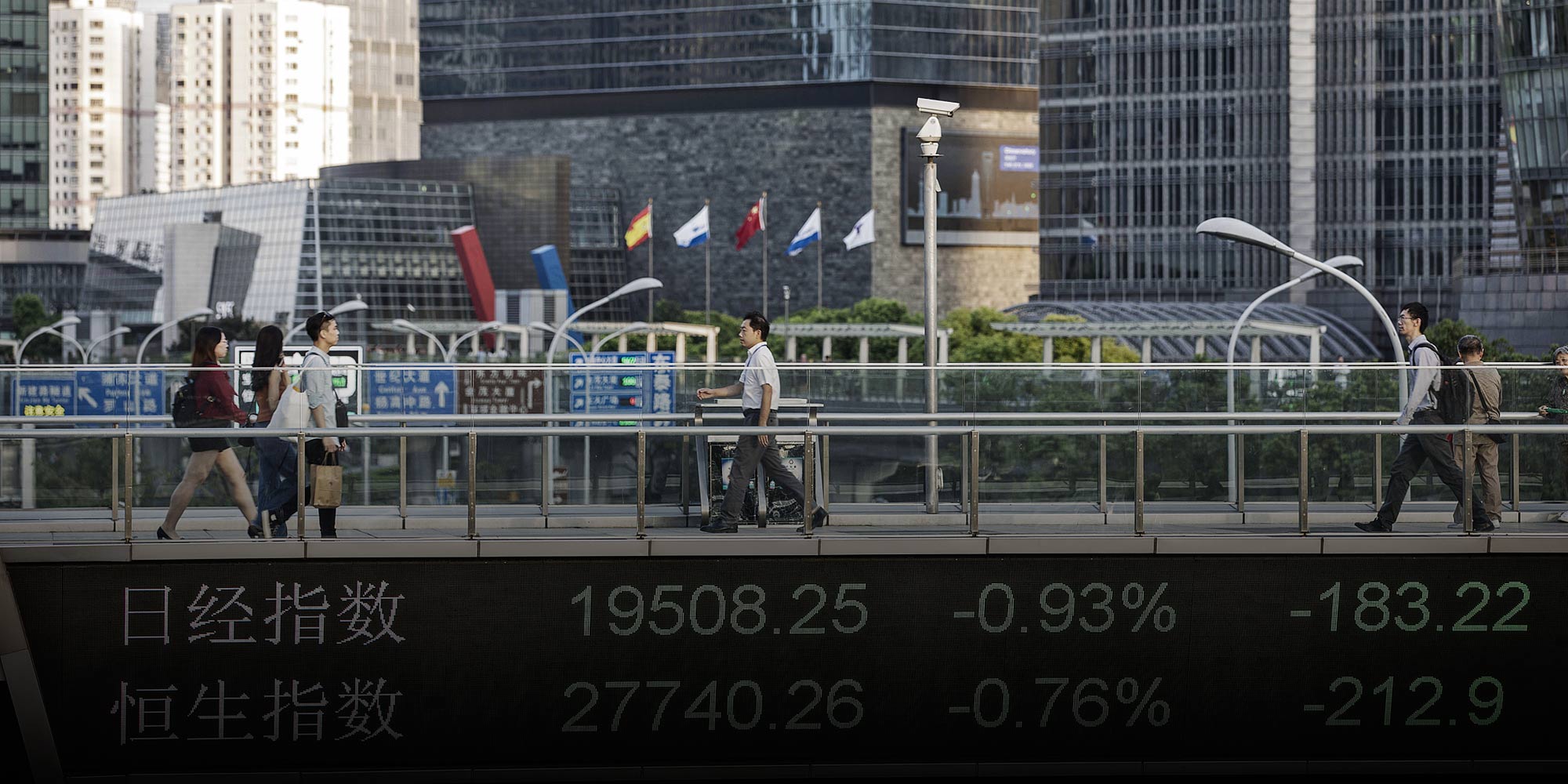

(Header image: Pedestrians walk along an elevated walkway in the Lujiazui Financial District in Shanghai, Sept. 4, 2017. Qilai Shen/Bloomberg/VCG)