Becoming Shein: Chinese Retailers Eye the Global Fast-Fashion Market

Everyone wants to be Shein: the $15 billion Chinese fast-fashion retailer that successfully cracked overseas Gen-Z markets by churning out trending apparel at ultra-low prices.

The firm has come to be seen as a paradigm for successful cross-border e-commerce, after overtaking Zara and H&M as the U.S.’s top-selling fast-fashion retailer earlier this year. Now, the Shein imitators are here.

Sixth Tone has found at least 10 Chinese fast-fashion companies similarly chasing global consumers, including Cider, Urbanic, ChicV, Doublefs, Cupshe, JollyChic. Five have been founded since the start of 2019, and three since the start of this year.

These fast-fashion brands mainly direct overseas Gen-Z and millennial shoppers to their independent e-commerce websites via advertisements on Instagram, mostly targeting the feeds of young female users. On YouTube and TikTok, hundreds of influencers post shopping hauls that range from 10 to 20 pieces per video featuring these brands. Zaful, a swimwear brand and one of the largest of the crop, has over 5 million followers on its main Instagram account, and a few thousand on each of its several country-specific accounts, including Russia and Australia.

According to an estimate from global consultancy Deloitte, Shein and its imitators will sell 150 to 200 billion yuan ($23.5 to 31.4 billion) in apparel in 2021. “Shein takes up the largest share with 100 billion yuan gross merchandise value (GMV), companies in the second echelon are sized at around 1 to 5 billion yuan, and there are many more with a GMV under 1 billion,” Pu Qinglu, a partner at Deloitte and one of the authors of a 2020 report on China Fashion E-Commerce Global Growth, told Sixth Tone.

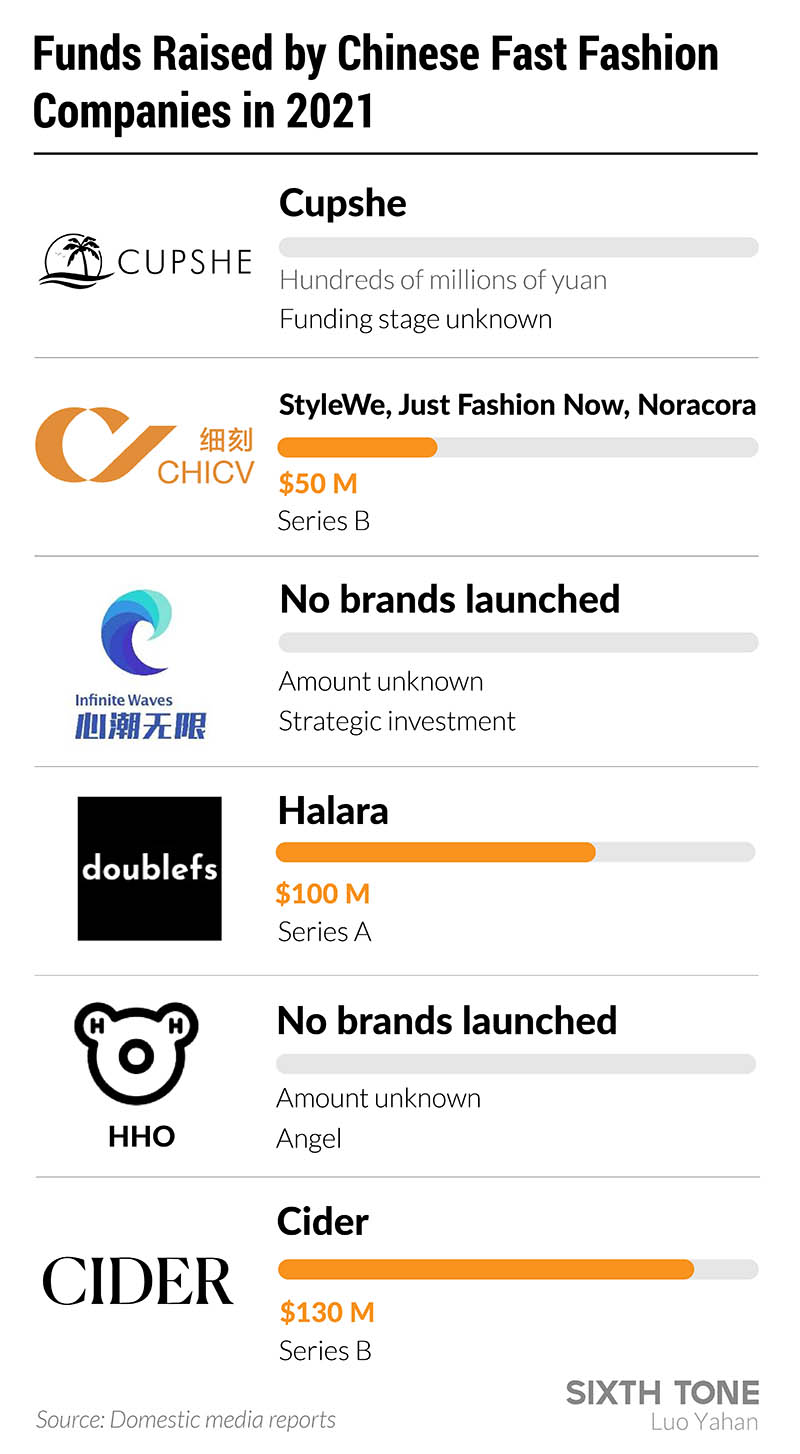

The flock of new companies all boast affordable prices and rely on social media influencers for marketing. Companies like these attracted at least $300 million in investment in 2021, based on deals reported in the media. The one-year-old Doublefs, which sells sportswear in the $30 to $50 range under the name Halara, recently closed its latest round of investment, worth $100 million, from venture capital firms including Capital Today and Hike Capital.

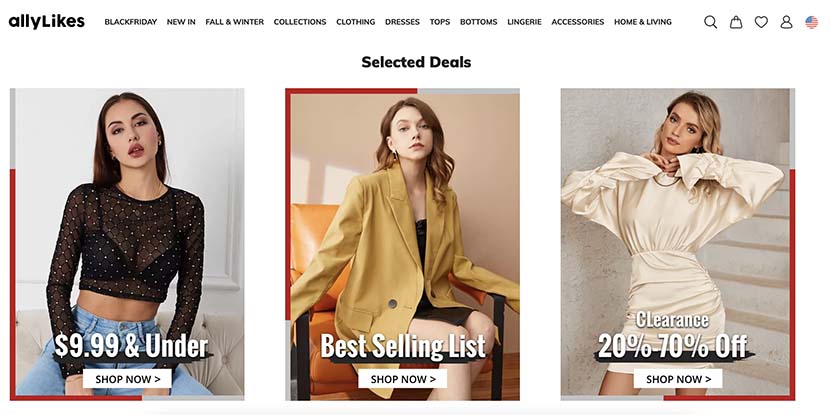

Chinese tech giants have also jumped on the brandwagon. Alibaba started selling women’s clothes via an independent website called allyLikes for the U.K., Europe, the United States, and Canada in June. The site is pitched at a low price point, with “9.99 and under” featured at the top of the site a week before Black Friday. TikTok owner Bytedance invested an undisclosed amount in the fast-fashion start-up Infinite Waves in June. The latter start-up has not yielded any publicly known products.

It is clear to Anna Xu, a partner at Hike Capital, why so many startups and investors want to enter the fast-fashion market: When she sees Doublefs, the veteran investor said, she doesn’t see a fashion company, but an opportunity that is driven by “digitalization.”

Modeled after Shein’s data and algorithm-driven supply chain, many similar companies can usually churn out clothing from design to delivery in seven days, according to domestic media reports.

“The honeymoon era for the internet industry is almost over. As the growth fades, people have to go into industries to digitize physical economies,” Xu said. “China’s production capability can support world-class products.”

Xu’s thoughts are echoed in Deloitte’s report, which says it is a great time for domestic fashion e-commerce merchants to go overseas given that China’s e-commerce market, which is dominated by giants like Alibaba, JD.com, and Pinduoduo, leaves limited space for growth.

Increasingly, Chinese manufacturers are moving from the wholesale trade to direct sales to consumers around the world. In the first half of 2021, the trading volume of Chinese cross-border e-commerce accounted for around one-third of China’s import and export volume, reaching 600 million yuan in total, according to a recent report by the China-based market research platform 100EC.com.

However, cheap manufacturing comes at a cost, especially when these companies’ production is outsourced to thousands of workshops scattered across China. Earlier this year, a Sixth Tone investigation found that many Shein products are made at contract factories that flout labor and fire safety regulations. Swiss advocacy group Public Eye also recently reported that workers at certain Shein suppliers work up to 75 hours a week in poor conditions, which violate numerous Chinese labor laws.

In a statement, the company replied that it works with the factories that manfuacture its goods to improve working conditions. Factories that work with Shein, it wrote, "see significant improvments in everything from competitiveness to worker compensation. In addition to providing technology, we also offer guidance on operations and management, and make investments in their working environment and conditions. As a lawful company, all of our partnerships are based on fair and equitable market principles."

The company also argues that its targeted manufacturing strategy reduces waste and improves sustainability. “Using real-time analysis of fashion trends, all of our products start from small orders of 100 to 200, while the industry standard is at least a few thousands or tens of thousands,” a Shein spokesperson said. “That way, we have little waste.”

Nevertheless, sustainability experts say fast-fashion companies need to do much more. “To become sustainable, they need to overhaul their business model,” said Karen Du, the head of Shanghai-based sustainable fashion organization R.I.S.E. Lab. “They need to make sustainability something that all consumers can participate in with ease and convenience.”

This story has been updated to add a statement from Shein in response to the allegations of poor working conditions described above.

Editor: David Cohen.

(Header image: A screenshot of Alibaba's Shein-like e-commerce platform, which started selling female clothes to the U.K., Europe, the United States, and Canada in recent months. From allyLikes)