The Chinese Dining Chains Making a Play for World Domination

When 21-year-old Chang Le was feeling homesick while on a recent six-month study-abroad program in Massachusetts, he knew he was never far from a good meal.

“I was excited but also surprised to see Haidilao abroad,” says Chang, a student from the southern city of Guangzhou, referring to China’s hugely popular hot pot chain. “It was more expensive, and some dishes weren’t as authentic or as fresh as in China, but it’s still the taste of home.”

Chinese cuisine outside of China has come a long way since the days of kung pao and oyster pails, with second- and third-generation immigrants around the world opening acclaimed restaurants serving authentic regional cuisine from across the country. But for recent emigrants, it can be tough to beat the food they grew up with back home.

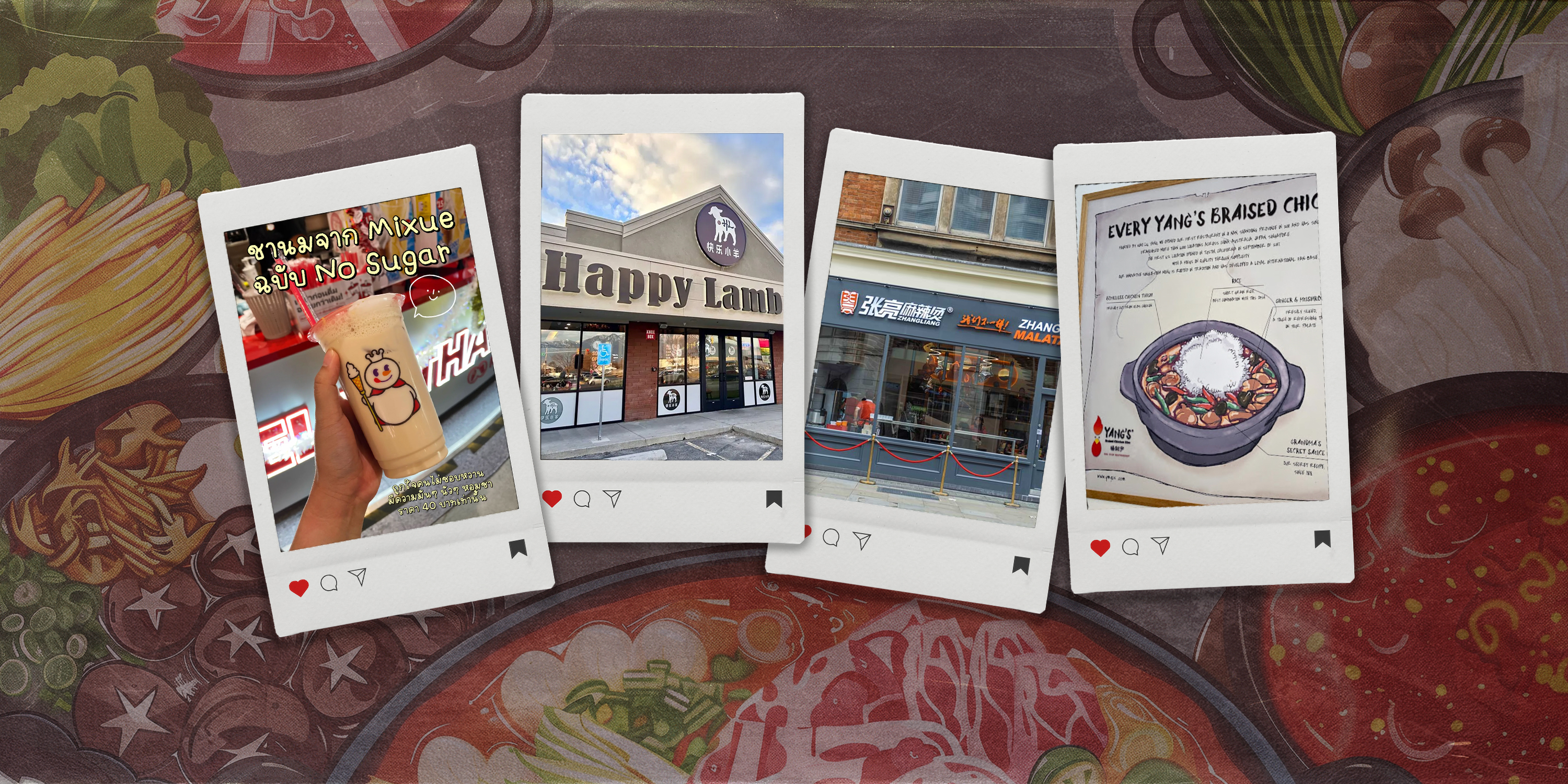

That demand has helped fuel the overseas ambitions of a number of leading Chinese chains including Yang’s Braised Chicken Rice, mini-hot pot brand Zhangliang Malatang, and beverage giant Mixue.

Currently, there are dozens of Chinese brands operating overseas, covering just about every kind of Chinese cuisine imaginable. But two types stand head and shoulders above the rest: hot pot and milk tea.

Fire and spice

Since opening its first overseas location in Singapore in 2012, Haidilao has built an empire of 122 overseas restaurants stretching from the United States to Australia. Super Hi International, which operates Haidilao’s overseas business, reported $356 million in revenue for the first half of 2024, up more than 10% year over year.

But Haidilao wasn’t the only, or even the first, mainland hot pot brand to try overseas expansion. That would be Chongqing Little Swan, which opened a branch in Seattle all the way back in 1995. More domestic hot pot brands, including Happy Lamb and Liuyishou Hot Pot, would launch overseas beginning in the 2010s.

One of the drivers of hot pot’s relative success abroad is its simplicity. Most brands use pre-prepared, pre-packaged hot pot bases, and ingredients are basic and easy to source.

Hot pot’s prevalence has helped make Sichuanese the most popular regional cuisine outside China, but chains selling other Sichuanese dishes have not always been able to replicate its success. Although Sichuanese brands have opened more locations abroad than those from any other region, the combination of a lack of skilled chefs and difficulty sourcing ingredients means that most, even those that expanded early, still operate fewer than 10 locations abroad. Baguo Buyi, which specializes in Sichuanese pickled fish, opened its first restaurant in the United States in 2013; today it operates just two locations in the country.

The tao of tea

The real champion of China’s overseas expansion boom may not be a dining establishment at all, but a milk tea brand: Mixue. Known in China for its low prices — a reputation that has made it a favorite of consumers in smaller, less economically developed towns and cities — Mixue has expanded rapidly overseas over the past six years, going from a single branch in Vietnam in 2018 to over 4,000 overseas locations today.

Like other milk tea brands, much of this expansion is concentrated in Southeast Asia. Mixue is estimated to have more than 1,000 locations in Vietnam alone. Hey Tea, which caters to a more middle-class consumer base, launched its first overseas expansion in November 2018, in Singapore, and entered the Malaysian market last year. Another high-end tea brand, Nayuki, also launched a Southeast Asian expansion in 2023, opening a new flagship store in the Thai capital Bangkok.

Southeast Asia offers clear advantages for Chinese companies looking to make their first foray abroad, including a large Chinese diaspora and a young consumer base. Singapore, where 63% of the population is of Chinese descent, and diners have plenty of money to spend, is a particular favorite for middle-class-oriented brands like Xiao Long Kan Hotpot, Tai Er pickled fish, and Hey Tea.

(Header image: Fu Xiaofan/Sixth Tone)